Recent News

-

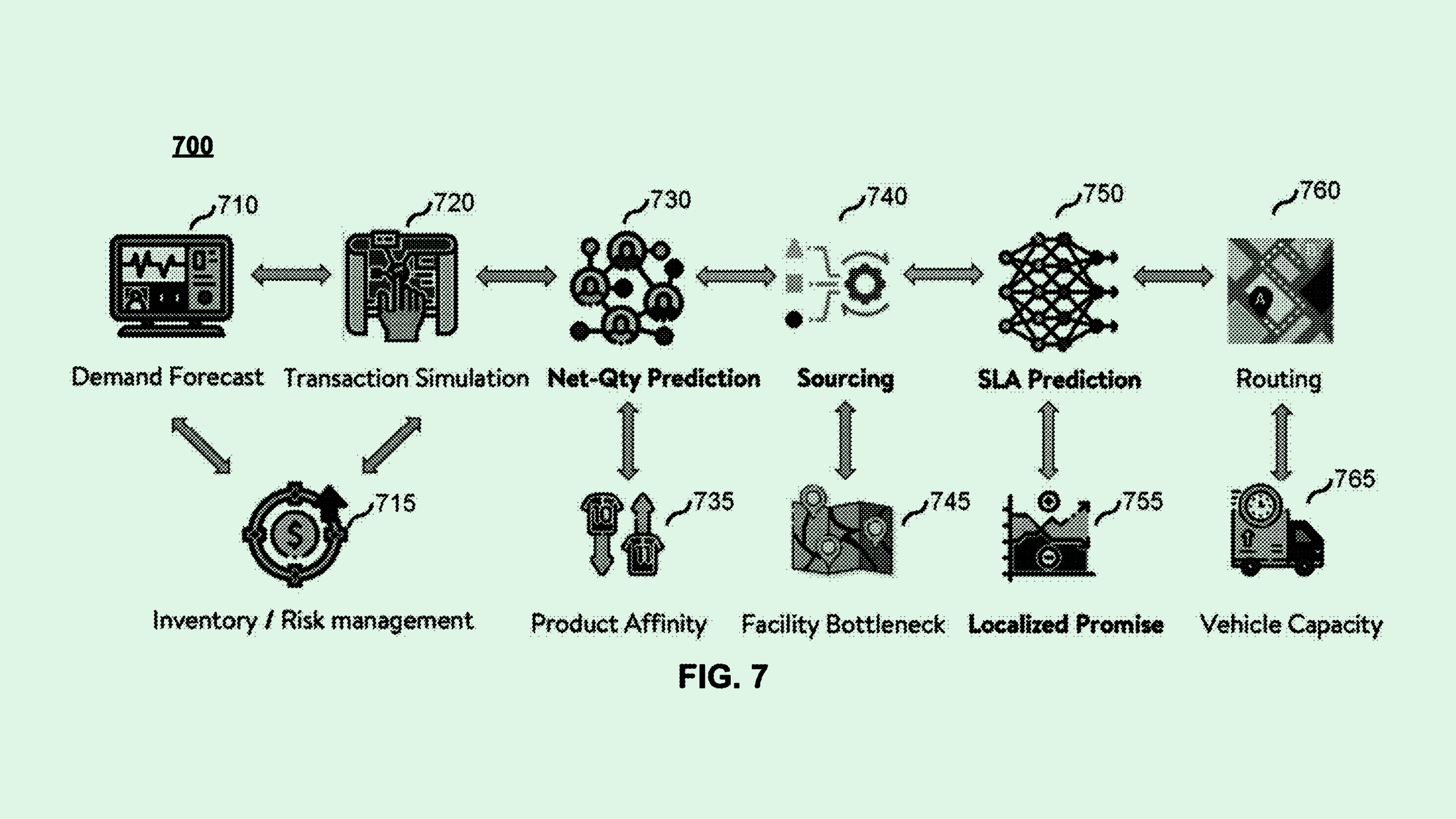

Walmart Patent Signals AI Transformation for Bricks-and-Mortar Retail

Photo via U.S. Patent and Trademark Office -

Why AI Augmentation Tech Is More Than a ‘Cost-Cutting Tool’

Photo via Rawpixel -

Why Access Controls May Be AI’s Biggest Security Vulnerability

Photo via Pavlo Gonchar

The Daily Upside newsletter delivers exclusive news and sharp analysis on finance and investing—all for free.