Berkshire Hathaway

-

All in the Franchise: Why Private Equity Loves the Business Model

Photo illustration by Connor Lin / The Daily Upside, Photo by Rawpixel via Freepik

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Warren Buffett Doesn’t See Much Reason to Deplete Huge Cash Pile

(Photo Credit: Serba Sembilan/Flickr)

-

What’s Eating Warren Buffett?

(Photo Credit: Serba Sembilan/Flickr)

-

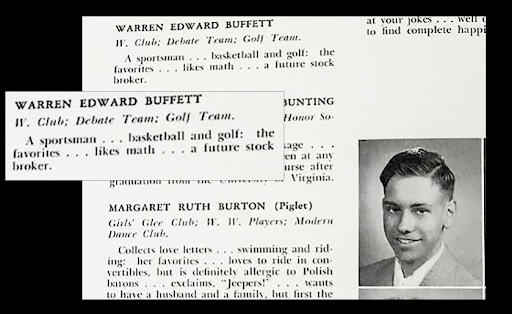

Tale of the Tape: Warren Buffett and Cathie Wood

-

Berkshire Poured $51 Billion Into Stocks in the First Three Months of 2022

Image Credit: Adobe.com -

Warren Buffett’s Berkshire is Back With an $11.6 Billion Insurance Acquisition

Image Credit: Adobe.com