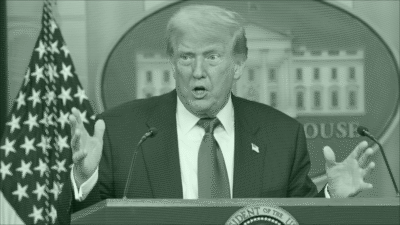

Donald Trump

-

Trump Media Delays Registration for Bitcoin ETF

Photo via Hu Yousong / Xinhua News Agency/Newscom

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Trump’s ‘Big, Beautiful Bill’ Is a ‘Mixed Bag’ for Advisors

Photo via Chris Kleponis-CNP/Picture Alliance/Consolidated News Photos/Newscom