Energy

-

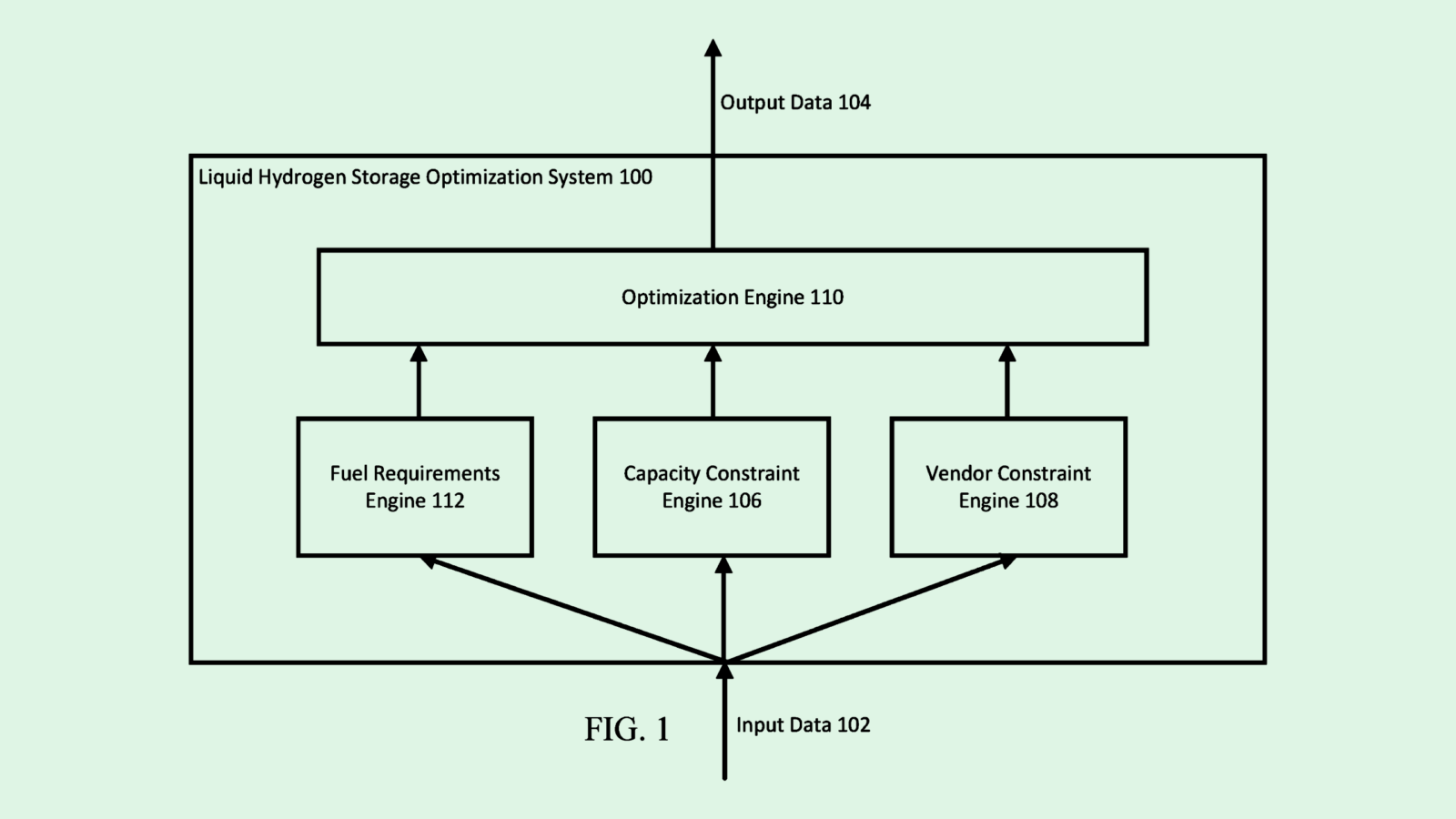

Microsoft May See Cryogens as Key to Data Centers’ Energy Problem

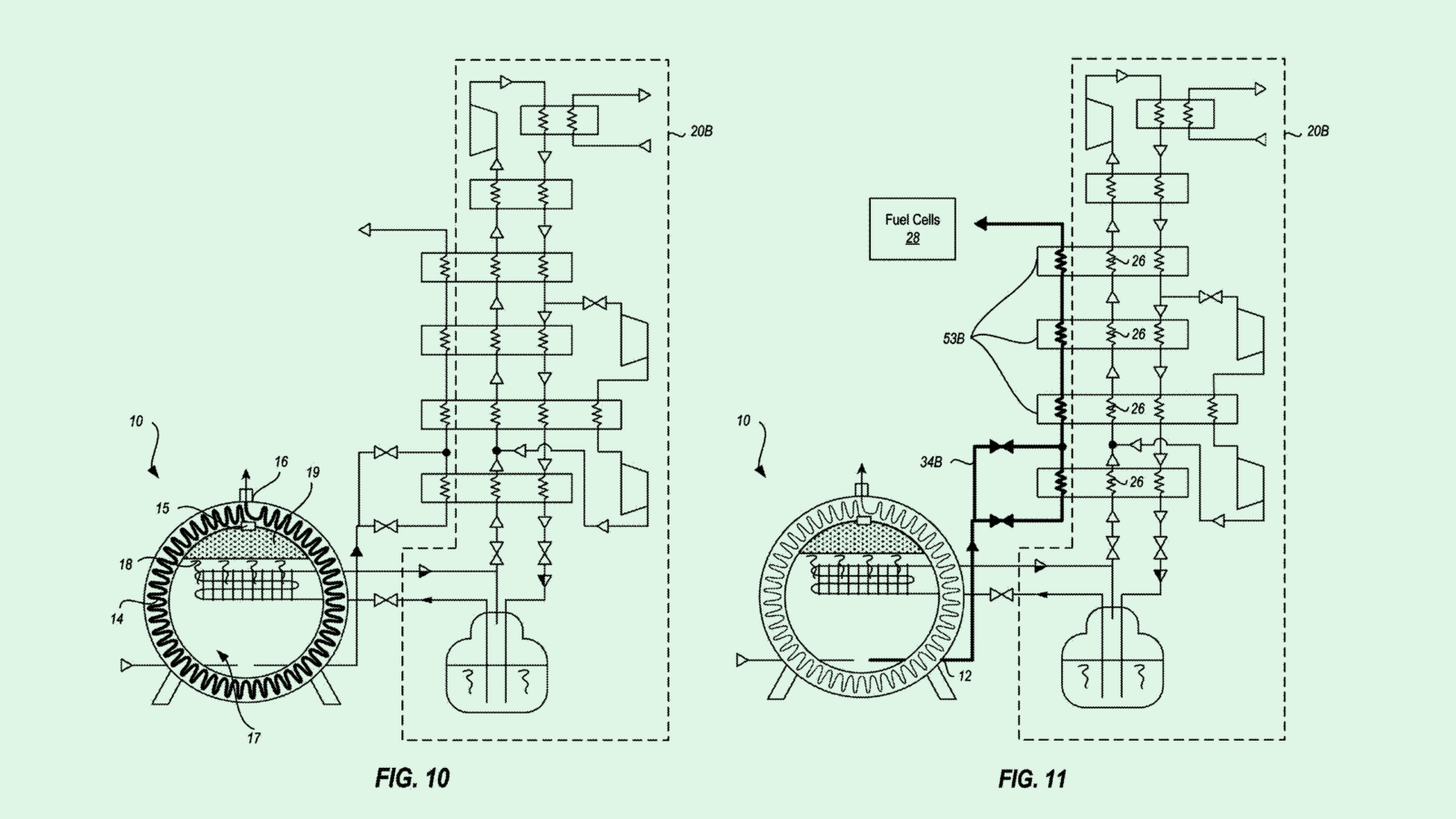

Photo via U.S. Patent and Trademark Office

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

OPEC+ Wants to Prop Up Falling Oil Prices

Photo by Zukiman Mohamad via Pexels -

Google Patent Eyes Hydrogen for Data Centers as Energy Use Soars

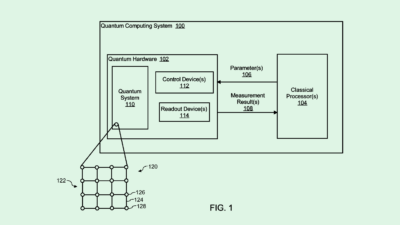

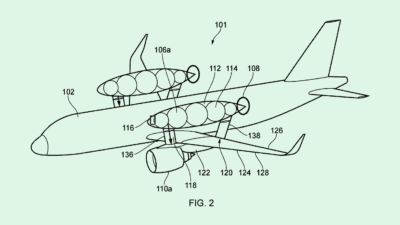

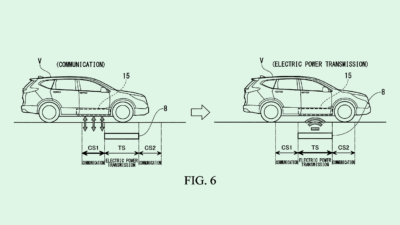

Photo via U.S. Patent and Trademark Office -

US Dithering on Hydrogen Gives Foreign Investment a Way In

Photo by Etienne Girardet via Unsplash