mastercard

-

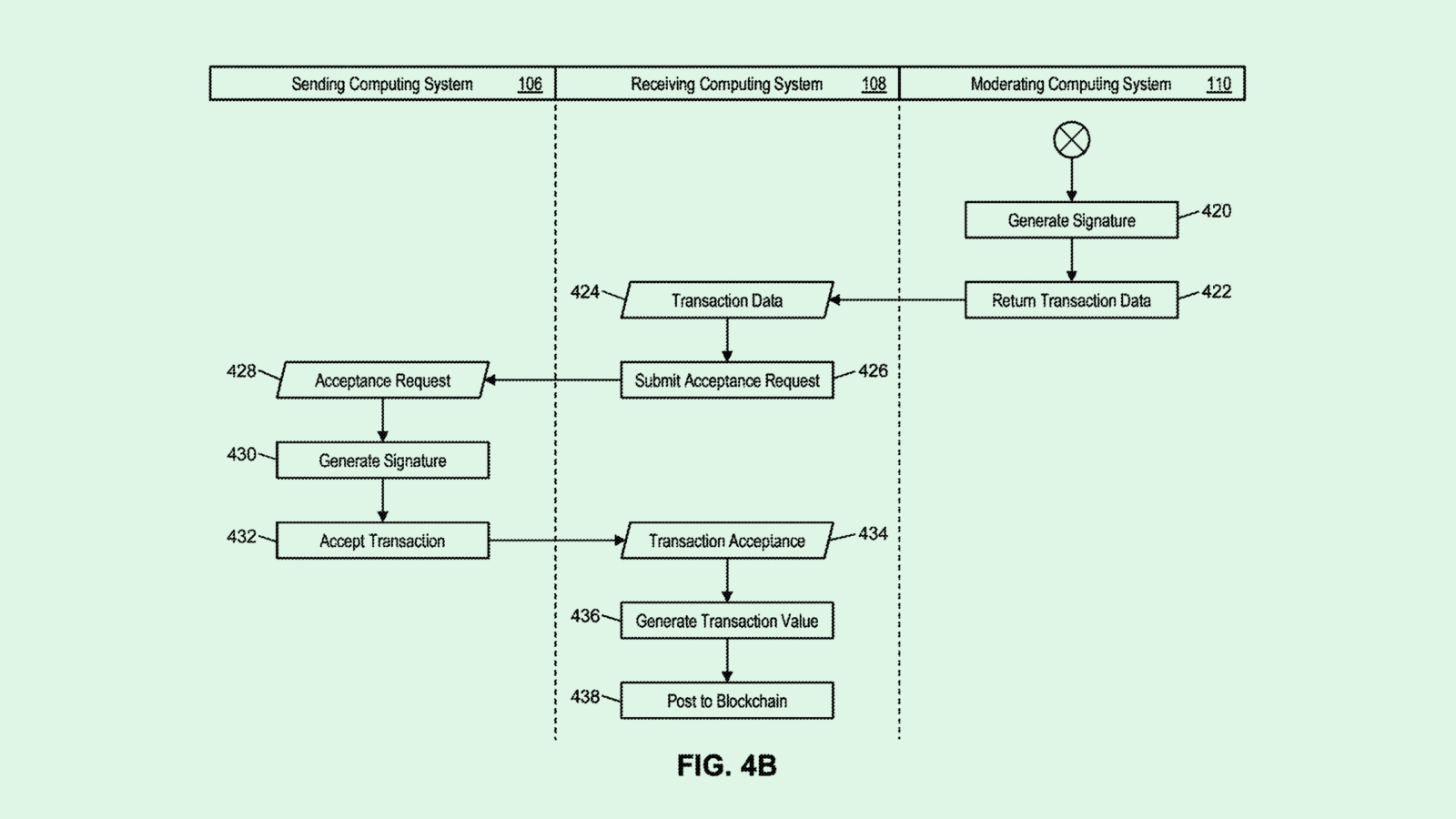

Mastercard Blockchain Patent Could Make Financial Audits Easier

Photo via U.S. Patent and Trademark Office

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

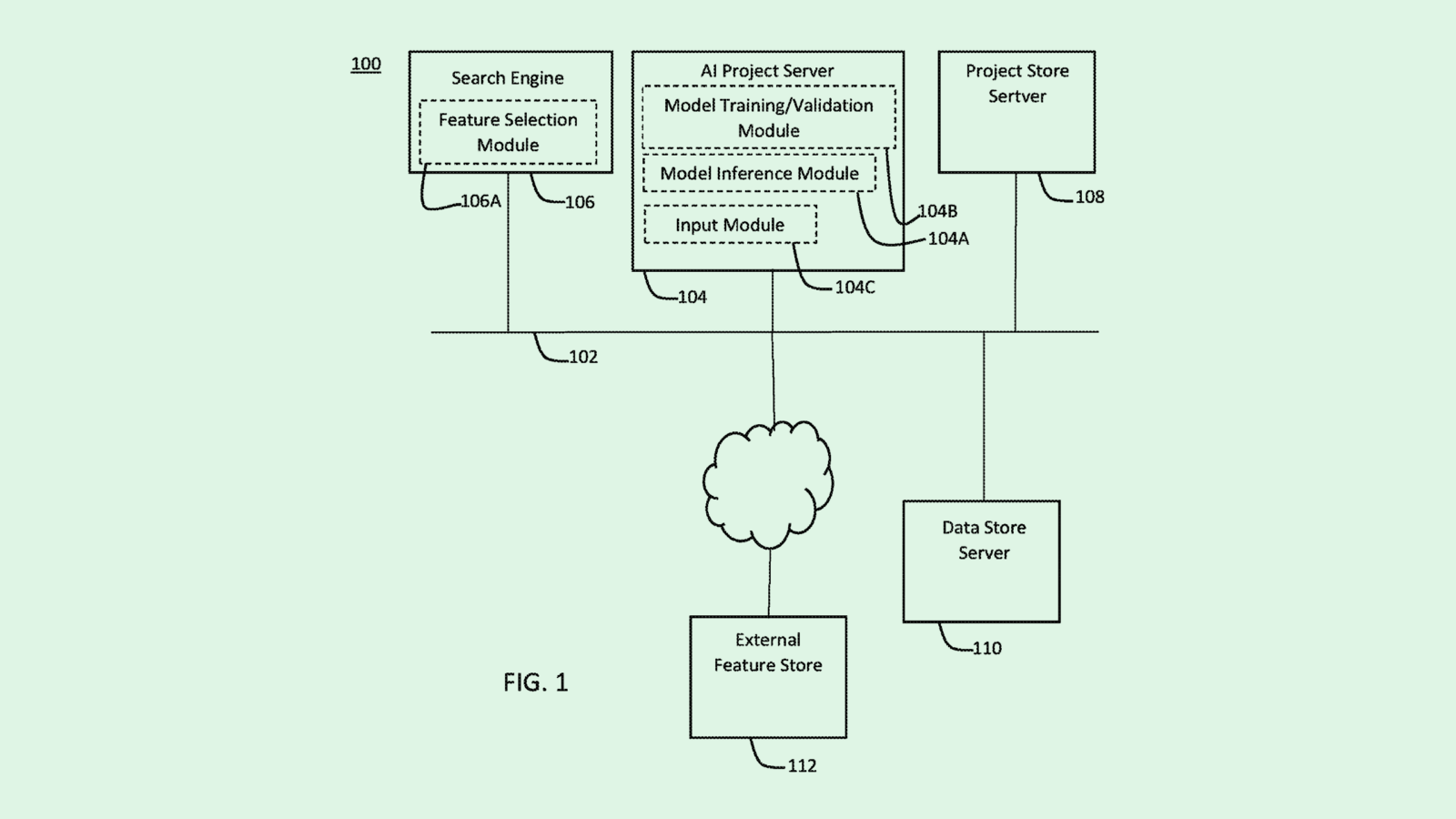

Mastercard Patent Speedruns AI Development

Photo via U.S. Patent and Trademark Office

-

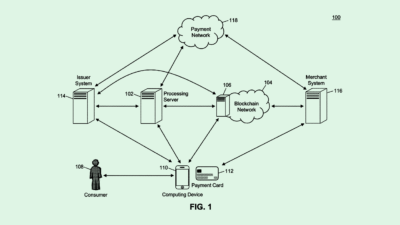

Mastercard Wants to Create a Back-up Plan for Lost Crypto

Photo by Shubham Dhage on Unsplash.

-

Major US Banks Develop Digital Wallet to Compete with PayPal and Apple Pay

(Photo Credit: Stephen Philips/Unsplash) -

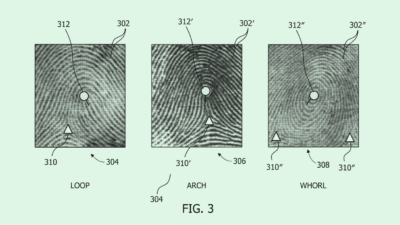

Mastercard Allows Customers to Pay at Checkout With a Wave of the Hand

Image Credit: iStock, fizkes -

Big Banks May Use Payment Service Zelle to Take on Mastercard and Visa

Image Credit: iStock, Massimo Giachetti